The e-commerce air cargo sector is experiencing an unprecedented surge and is expected to grow remarkably in the coming years. According to Andre Majeres, the Head of E-commerce, Cargo, and Mail Operations at the International Air Transport Association (IATA), e-commerce’s share of total air cargo volumes is projected to rise significantly from 20% to 30% by 2027. Speaking at the World Cargo Symposium (WCS) in Hong Kong between 12th and 14th March 2024, Majeres further highlighted that the exponential expansion of online shopping drives this increase.

“We expect the demand for general cargo and e-commerce to increase, which will require more dedicated air freight,” said Atlas Air’s CEO Michael Steen in an interview with The STAT Trade Times at the IATA’s Hong Kong symposium. Other airlines, including Astral Aviation, have also observed e-commerce air cargo demand. At the Flower and Perishable Logistics Africa 2024 conference in Nairobi last month, Astral Aviation’s Chief Commercial Officer mentioned that 40% of their cargo is e-commerce packages. During the same event, Saudia Cargo’s Regional Sales Director Africa, Ken Mbogo, also stated that they have seen increased demand for freighter capacity due to heavy competition from e-commerce businesses. “E-commerce is what drives air cargo,” said Majeres during a presentation at the Hong Kong event. “Today, approximately 1 out of 5 packages in air cargo comes from e-commerce (companies). Soon, that number will increase, and 1 out of 3 packages will come from e-commerce,” Majeres added.

Similarly, Dimerco Asia Pacific Monthly Freight Report for March to April 2024 notes that air freight is growing due to e-commerce in South China but faces challenges in Europe due to the Red Sea crisis and labour strikes at Lufthansa. Despite those challenges, airlines have sold out all Year 2024 Block Space Agreements to destinations in the United States and European Union. Kathy Liu, Senior Director of Global Sales at Dimerco, predicts a promising future for air freight in 2024. The e-commerce sector’s optimistic outlook drives this demand. Liu added, “The optimistic outlook for the e-commerce sector fuels this surge in demand.

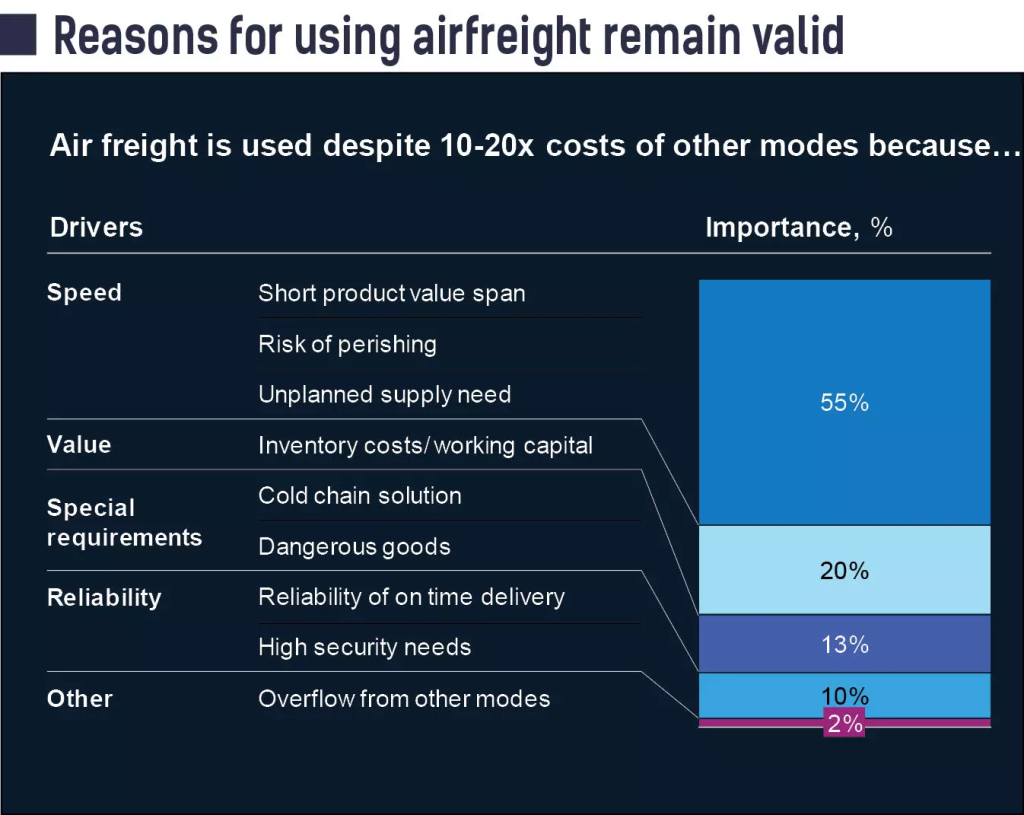

At the Hong Kong Symposium, Ludwig Hausmann, Senior Partner at McKinsey, mentioned, “Air freight is used despite 10-20 times the cost of other modes of transport, speed being the primary reason.” Apart from speed, other factors that contribute to choosing air freight include value, special requirements, reliability of on-time delivery, and overflow from different modes of transport. During the same event, Majeres also highlighted that there is now more access to the Internet and online stores than ever before, which is a positive sign for the e-commerce sector.

Speaking to The STAT Trade Times, Michael Pakula, CEO of BoxC, shared that with the help of technology, carriers can create new products, such as e-commerce small parcel shipping programs. This results in increased asset utilisation, improved return on investment, and the ability to offer a new product to existing and new customers. Furthermore, it promotes sustainability by reducing excess capacity and allowing cargo carriers to ‘virtual zone skip’ for increased efficiency. BoxC is an e-commerce logistics management platform that allows businesses to manage all aspects of international e-commerce logistics. BoxC’s Pakula also emphasised that technology is vital in providing supply chain partners with the data required to meet internal and external compliance. Technology is the only way forward to maintain and improve transit times by reducing choke points in the global supply chain. Sharing data between all parties in the supply chain, including cargo carriers, improves the supply chain’s and assets’ safety, enhances transit times, and helps regulatory authorities better identify bad actors. In addition, Astral Aviation’s Patricia said, “Airlines and producers must work together to ensure efficiency, customer convenience and the right pricing strategy. Moreover, we need more players in the e-commerce industry to invest in African e-commerce terminals.” The growing market presents numerous opportunities for investors willing to adapt to the shifting landscape. Hong Kong, an important centre for e-commerce, is witnessing a notable rise in air cargo volumes. To meet the increasing demands of e-commerce logistics, Hong Kong is collaborating with industry leaders like Alibaba and taking initiatives to enhance its supply chain infrastructure. Alibaba Group Holding is expanding its “five-day delivery” service to compete with rivals such as Temu and Shein and take advantage of the growing market. Customers shopping on AliExpress can expect to receive their packages within five days through Cainiao, Alibaba’s logistics arm. Alibaba has also introduced its delivery service in countries like Germany, France, Portugal, Saudi Arabia, and Mexico. Factors affecting this surge in e-commerce air cargo Consumer spending remained strong in 2023 despite inflation and high-interest rates. The US GDP grew by 3.3% in Q4 2023, exceeding expectations. Annually, there was a 2.5% increase in 2023, mainly fueled by strong consumer and government spending. Core inflation remained stable at 2.0%. These positive economic indicators suggest a promising outlook for a ‘soft landing’ scenario. Majeres presented in Hong Kong also revealed that during times of crisis, such as pandemics, wars, or supply chain disruptions, consumers tend to seek better deals due to the impact on their cost of living. He further highlighted that 34% of consumers shop online at least once a week, while 79% do so monthly. In 2023, 30% of consumers bought more goods online, with 26% prioritising the speed of delivery in their purchasing decisions. Worldwide retail sales increased from $26.4 trillion in 2021 to $29.7 trillion in 2023 and are expected to reach $33.7 trillion by 2026. However, growth is slowing down. In contrast, e-commerce retail sales grew from $3.3 trillion in 2019 to $5.7 trillion in 2023 and are expected to hit $8 trillion by 2027. In cross-border e-commerce, 80% of the goods are flown by air, creating a lucrative opportunity for e-commerce air cargo partners.